(July 21, 2024)

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

In recent years, the landscape of mortgage options in Canada has witnessed a notable shift with the resurgence of 30-year mortgage amortizations. This resurgence follows a significant policy change by the Federal Government (effective August 1, 2024) aimed at supporting first-time home buyers. Under the new policy, purchasers of newly constructed homes are now eligible to secure mortgages with a 30-year amortization period, even with a down payment of less than 20%. Traditionally, such extended terms were restricted to buyers with down payments of 20% or higher (aka uninsured conventional mortgages).

To understand the impact of this new policy and its implications for first time home buyers, here are the precise guidelines as drafted by the Federal Government:

- at least one of the borrowers on the mortgage application must be considered a first-time homebuyer. Following are the criteria to be considered an eligible first time home buyer (as defined by the Government of Canada):

- the borrower has never purchased a home before,

- in the last 4 years, the borrower has not occupied a home as a principal place of residence that either they themselves or their current spouse or common-law partner owned,

- the borrower recently experienced the breakdown of a marriage or common-law partnership. On this point, the regulations that the Canada Revenue Agency has taken with respect to the Home Buyers Plan

- Newly Constructed Home: the property that the borrower is purchasing must be a newly constructed home. To be considered a newly constructed home, the new home must not have been previously occupied for residential purposes. This requirement is not intended to exclude newly constructed condominiums where there has been an interim occupancy period.

- the property purchase price (including GST) must be below $1M (as per existing high ratio/insured mortgage qualification guidelines in Canada)

- these eligibility criteria are void if the borrowers have a 20% down payment or higher which under existing mortgage qualification rules allows you to qualify with a 30 year mortgage regardless of the aforementioned stipulations

- this new qualification policy comes into effect on August 1, 2024

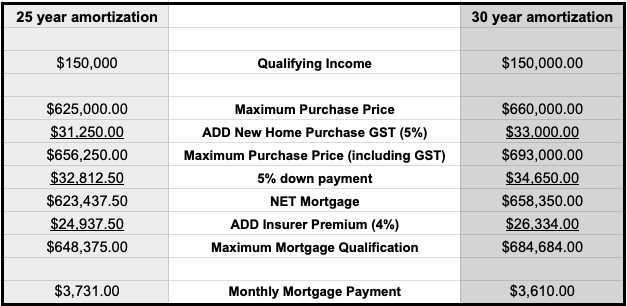

Here is a table that compares the impact of the new 30 year amortization rule when compared to a 25 year amortization for newly constructed homes in Canada using an annual qualifying income of $150,000 (individually or combined applicants income):

Conclusion:

The impact of this initiative varies significantly. For instance, in Alberta, it could be the catalyst needed to purchase a spacious 2-storey single-family home with a garage and backyard. In contrast, Vancouver’s housing market may see minimal effects, as condos under $660,000 are scarce, if not nonexistent. Eligibility for newly built homes in Vancouver is practically inconceivable, given starting prices are well above $1 million. Thus, across Canada, the guideline’s influence ranges from substantial in places like Calgary and Edmonton, to negligible or nonexistent in other cities (most notably, Vancouver and Toronto). However, despite its varied impact across the country, it does present a significant opportunity for eligible buyers in specific cities and price ranges—a niche advantage worth considering for those few who qualify.

Wondering if a 30-year amortization is a game changer for you? Call or text Marko Gelo right now at 604-800-9593, or Click Here to schedule a free, no-obligation phone call with Marko. You can also call Marko on WhatsApp.

Download my amazing Mortgage App…it’s loaded with calculators and tonnes of useful information!

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Download my award winning Mortgage App on your phone

Email: gelo.m@mortgagecentre.com

@markogelo (Twitter)