(Dec 14, 2023)

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

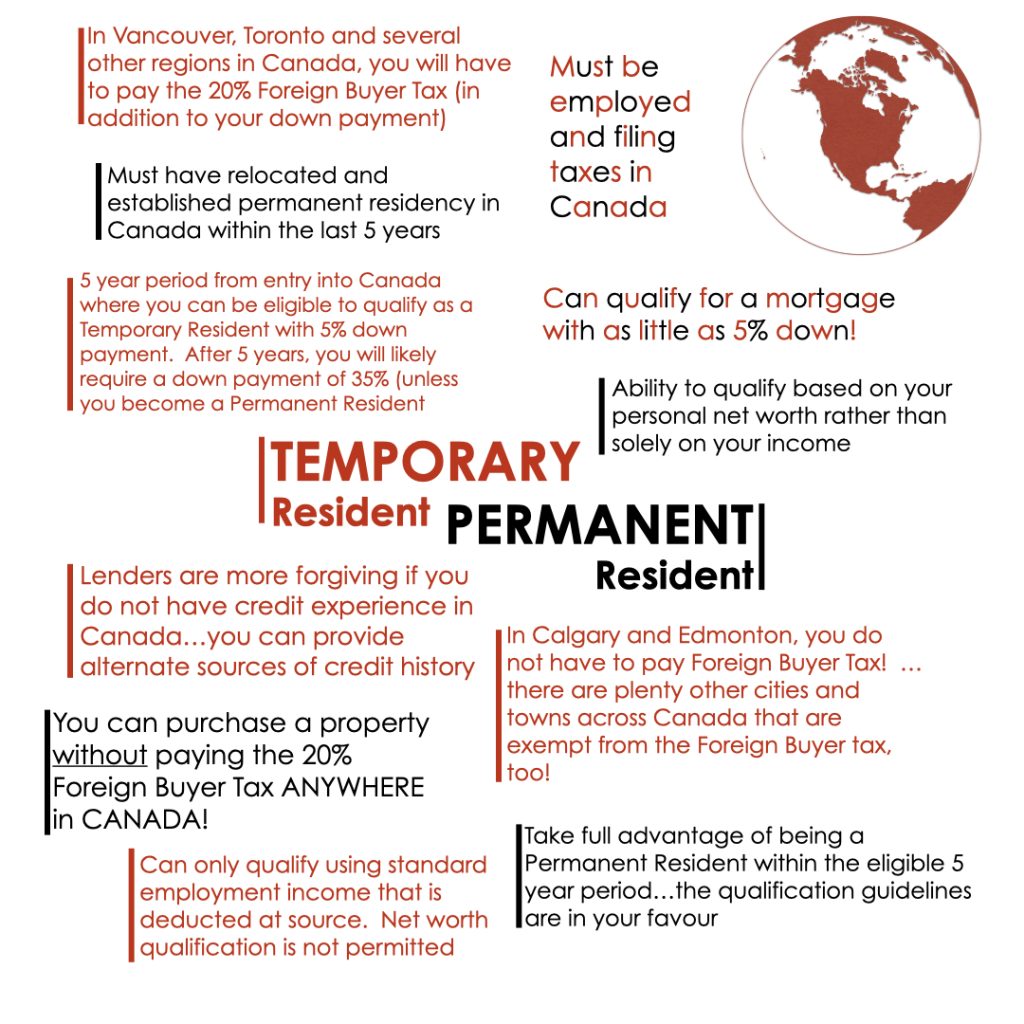

As per the current legislation in British Columbia, if you plan to purchase a property and are not a Canadian citizen, Permanent Resident, or Provincial Nominee, you’ll be subject to a Foreign Buyer Tax of 20% of the purchase price due at the time of completion. For instance, if you, as a work permit holder, buy an $800,000 property in Vancouver, you’d need to pay $160,000 in Foreign Buyer Tax. However, becoming a Permanent Resident exempts you from this tax. But what if you’re in a marital or common-law relationship with one partner being a Permanent Resident and the other a work-permit holder (mixed-immigration-status couple)? If you both buy a home, would you still have to pay the Foreign Buyer Tax?

The answer is yes, but an opportunity exists to minimize the tax (potentially as low as 1%). The process involves registering you, your spouse (if applicable), and your bank (if financing the purchase) on the land title upon buying a home. You can then allocate a specific ownership proportion between you and your spouse. Let’s now return to the mixed-immigration-status couple, where one is a Permanent Resident and the other a work permit holder, the latter, being liable for the Foreign Buyer Tax, can minimize their tax payable by assigning a minimal ownership share. For instance, if the Work Permit holder is registered as 1%, they would only pay 1% of the tax on a $1M purchase, reducing it from $160,000 to $1,600!

Here’s the catch—the non-Canadian spouse must meet all of the following conditions: (i) they must be married or common-law for at least 2 years (with verification via documents such as a marriage certificate, lease agreement, utilities statement, or bank statement, etc), (ii) the Work Permit holder’s down payment cannot exceed their registered ownership share, and (iii) they must comply with the Prohibition on the Purchase of Residential Property by Non-Canadians Act, holding a valid work permit with 183 days or more of validity at the time of purchase.

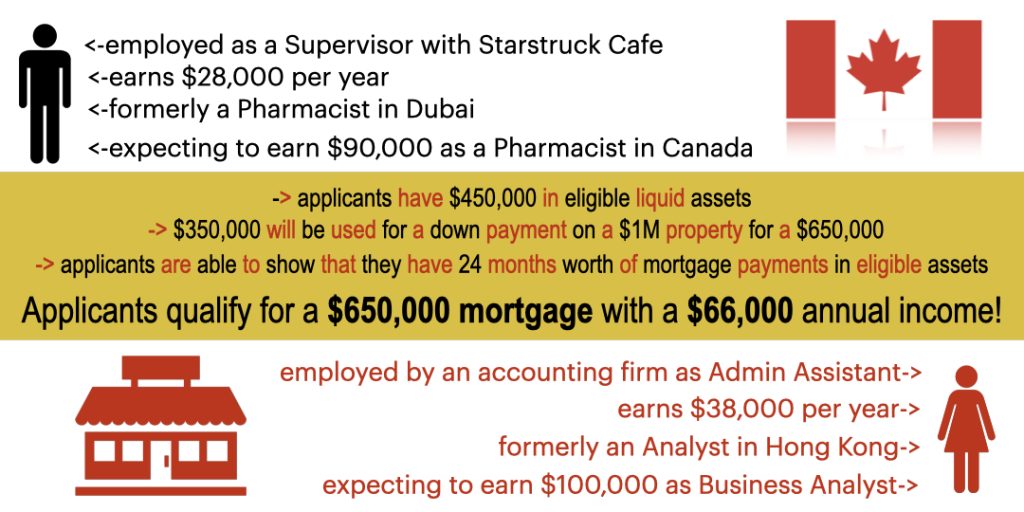

What about mortgage qualification?

Regardless of whether you hold temporary or permanent residency status, there are numerous mortgage qualification programs tailored for newcomers to Canada within the Canadian market. The key challenge lies in identifying a lender whose eligibility criteria align with your specific application profile. These New-to-Canada mortgage programs vary widely from one lender to another, underscoring the importance of connecting with a multi-offering mortgage broker rather than relying on a single-offer bank representative. Submitting a single application through a mortgage broker grants access to multiple lenders, enhancing your approval prospects. Moreover, the competitive bidding process ensures favourable rates and diverse product offerings. Marko Gelo specializes in mortgages for new Canadians; call him right now to discuss your goals or Click Here to schedule a call that is convenient to you.

Disclaimer: The information above is intended to raise awareness of possibilities, provided all conditions are met. If you find that you meet the criteria discussed, the next steps should be to begin the mortgage preQualification process and verify further with your real estate lawyer regarding your immigration status as it pertains to the Foreign Buyer Tax and the Prohibition on the Purchase of Residential Property by Non-Canadians Act . For a complete reference to the BC Foreign Buyer Tax, Click Here to be redirected to the official webpage of the British Columbia Provincial Government.

Feel like a quick chat about any of the above? Call or text Marko Gelo right now at 604-800-9593, or Click Here to schedule a free, no-obligation phone call with Marko. You can also call Marko on WhatsApp.

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email: gelo.m@mortgagecentre.com

@markogelo (Twitter)