(March 23, 2022)

Intro (pre-amble): up to 10:00 mark of podcast (which city has the highest average mortgage in Canada | keep an eye on interest rates, but don’t forget about taxes)

Living in Canada as a Temporary Resident can be confusing when it comes to mortgage qualification. Here is a summary of the key eligibility criteria for temporary residents seeking a mortgage with less than 20% down payment:

KEY ELIGIBILITY CRITERIA:

- temporary resident applicants must provide a valid work permit

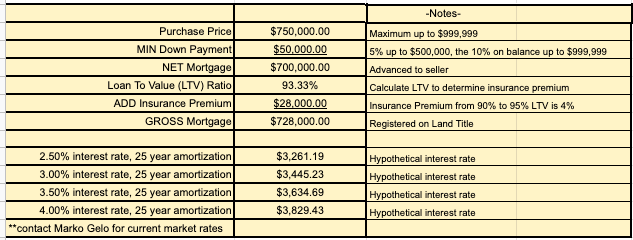

- minimum down payment of 5% up to $500,000, then 10% on the balance thereafter up to $999,999 (maximum purchase price with down payments less than 20%)

- All mortgages in Canada with down payments less than 20% are subject to a one time insurance premium that is tacked on to the mortgage principle. Mortgage premiums range from 2.80% to 4% and are scaled according to the loan to value ratio – the higher the loan-to-value ratio, the higher the insurance premium. It is important to note that the mortgage insurance is NOT an out of pocket expense, it is simply capitalized onto the mortgage principal. Here is a sample calculation for a $750,000 purchase:

- applicant must have full time employment with a minimum 3 month history (however those transferred under a corporate relocation program are exempt)

- can purchase a condo, townhome, single family dwelling, and duplex (where 1 unit must be owner occupied)

- new construction or resale properties are eligible funds for immediate home improvements can be added to mortgage proceeds from onset (up to 10% of the purchase price)first 5% of down payment proceeds must be from own sources (to be verified via bank statements). Remainder of down payment proceeds can be gifted from immediate family member or corporate subsidy remaining economic life of property should be at least 25 years

- temporary residents receive the same interest rates as permanent residents and Canadian citizens

- the following alternative sources of credit are accepted if Canadian origin credit sources haven’t been established while in Canada

- 12 months rental payment history confirmed by landlord and supported by 12 months of bank statements showing payment withdrawals, at least one utility payment (or cell phone) confirmed via letter from the service provider or 12 months of payments confirming regular payments

- international credit report from applicants country of origin,

- **all forms of alternative credit confirmation used to qualify must have been established in Canada

- all of the above allowances are granted if a Temporary Resident applicant has relocated to Canada within 5 years from the completion date of the purchase (exceptions can be made on a cases by case basis if the tenure exceeds 5 years)

OTHER RELATED ARTICLES:

The First Time Home Buyer Kit for Temporary & Permanent Residents

Can a Temporary Resident Qualify for a mortgage while working in Canada?

Qualifying for a mortgage as a BC Provincial Nominee

Contact Marko, he’s a Mortgage Broker!

604-800-9593 direct Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 direct Calgary (Click Here to schedule a call with Marko!)

@markogelo (Twitter)