(Oct 23, 2023)

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

In today’s Canadian mortgage landscape, one thing has the power to captivate the attention of economists, investors, and homeowners alike: rock-bottom interest rates. Whether you’re a first-time homebuyer hunting for your dream home or a seasoned investor looking to optimize your portfolio, the allure of historically low interest rates is undeniable. But have you ever wondered what’s behind it all? Which applicants get the best mortgage rates, and why? What is the one common factor that binds these rock-bottom interest rates together?

Let’s embark into the world of these exceptional mortgage rates and explore the three main forces that have led to their rock-bottom pricing. And more importantly, let’s determine if YOU are eligible for rock-bottom interest rates!

1. LOAN-TO-VALUE (LTV) RATIOS:

Loan-to-Value (LTV) ratios are a critical factor when it comes to interest rate pricing, but their influence can be somewhat perplexing. LTV ratios are as straightforward as they sound: it’s the ratio of your mortgage amount to your property’s value. For instance, if your property is worth $500,000 and your mortgage is $400,000, your LTV ratio is 80%. Mortgage rates tend to deviate within three key LTV ratio bands: (i) 65% or less, (ii) greater than 65% but less than 80%, and (iii) over 80% up to 95%. While you might expect that the more skin in the game, the better the rate, this isn’t always the case. Surprisingly, it’s the 80.01% to 95% band where you’ll find the rock-bottom mortgage rates. That’s right, the applicant with the least amount of down payment gets rewarded with the best interest rate! You’re probably asking, how does this make sense? Why would the applicant with the least amount of down payment get the best interest rate? To understand this paradox, let’s move on to the next factor, insurability.

2. INSURABILITY:

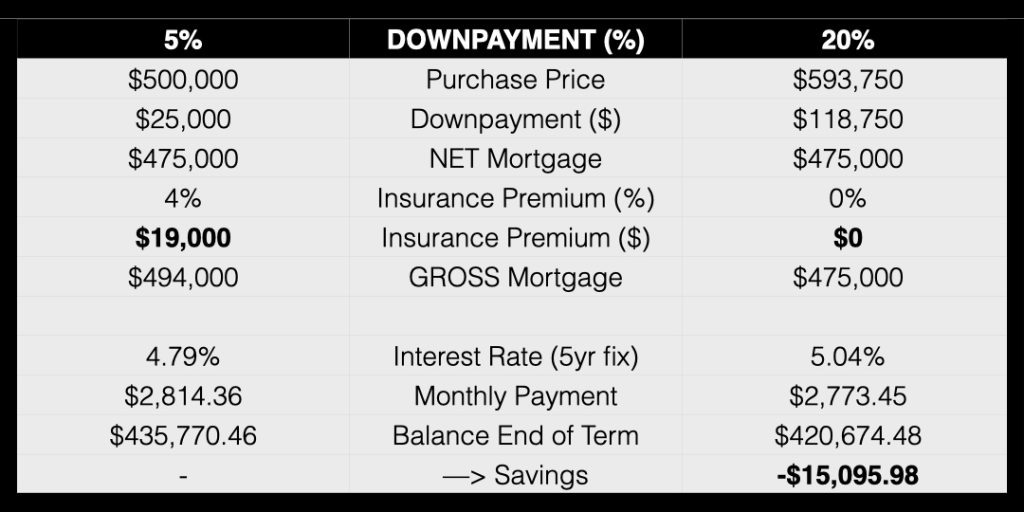

Within the three LTV ratio bands (65% or less, 65.01% to 80%, and 80.01% to 95%), the middle band, 65.01% to 80%, has the highest mortgage rates. Here’s the intriguing part: you’d assume that as the LTV ratio decreases, your interest rate would improve, and you’re correct in that assumption. However, in the 80.01% to 95% LTV ratio band, where you’d expect higher rates due to lower down payments, the situation is different. This band receives the best interest rates because mortgages in Canada with LTV ratios above 80% require insurance. Anytime you purchase a property with less than a 20% down payment, you incur a premium on your mortgage, ranging from 2.80% at 80.01% LTV up to 4% at 95% LTV. This premium insures against the likelihood of default, making these mortgages low-risk for lenders. The lower LTV band (65.01% to 80%) is often the highest-priced mortgage rate arena, as it’s uninsured and somewhat vulnerable to extreme market downturns. It is not until you reach the lower loan-to-value thresholds (below 65% LTV) where the risk factor essentially diminishes and the interest rates finally match those of the insured price bands.

3. PURCHASE PRICES:

Lastly, property values play a pivotal role in the rate-pricing criteria. All the factors mentioned apply to properties valued under $1 million. Once a property surpasses this threshold, Canada’s insurers no longer protect the mortgage against default. The coveted 80.01% to 95% LTV band, with its highly discounted interest rates, ceases to exist. For properties over $1 million, mortgages are not insurable, and the minimum down payment increases to 20% or higher, depending on the purchase price. For instance, a common sliding scale involves an 80% LTV up to $1.5 million, followed by a 60% LTV on the balance thereafter. With properties over $1 million, further risk premiums come into play due to the absence of insurability. Although an official 65.01% to 80% LTV pricing band doesn’t formally exist at this scale, lenders do eventually reach a comfort zone where their interest rates eventually match the interest rates offerings you would typically associate with the 80.01% to 95% LTV band.

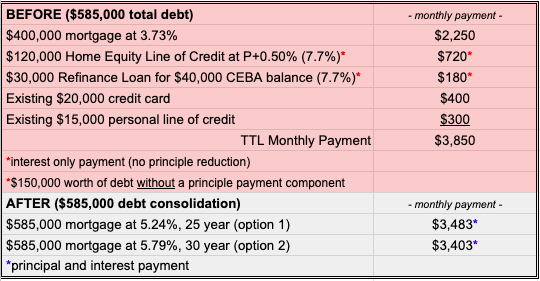

To sum it all up, here’s an example of how many interest rate pricing variations one could expect for a 5 year fixed rate (as of today’s rates, Oct 22, 2023)…these are just a few pricing scenario examples, there are several more not accounted for in this illustration:

SUMMARY:

The world of mortgage finance is a complex landscape, and understanding the factors that influence interest rates is crucial for homeowners and investors alike. Loan-to-Value (LTV) ratios, insurability, and property values are the key driving forces behind rate pricing, and they often defy common expectations. While a higher down payment may not always guarantee better rates, the presence of mortgage insurance can actually lead to more favorable terms. Property values, especially those exceeding $1 million, introduce additional complexities in rate structures. Lenders carefully weigh the risk factors in the quest to balance competitive rates with prudent lending. By unraveling these intricacies, borrowers can make informed decisions, ensuring that they secure the most favorable mortgage rates aligned with their financial goals. The mortgage industry’s subtleties, as we’ve explored, reveal that it’s more than just numbers; it’s a dynamic interplay of financial algorithms and calculated risk.

DISCLAIMER: For the sake of brevity, this post does not cover all interest-rate-influencing factors (for example, amortizations, occupancy status, and self-employment have an impact on interest rate pricing, but have not been discussed in this post). The key takeaway is that not all interest rates are created or offered equally. To ensure you receive the best possible rate, reach out to Marko Gelo for a brief summary analysis of your options. Call or text at 604-800-9593, or schedule a call with Marko at your convenience.

Wondering if you are eligible for rock-bottom interest rates? Call or text Marko Gelo right now to secure your rock-bottom interest rate at 604-800-9593, or Click Here to schedule a free, no-obligation phone call with Marko. You can also call Marko on WhatsApp.

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email: gelo.m@mortgagecentre.com

@markogelo (Twitter)