(May 22, 2023)

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

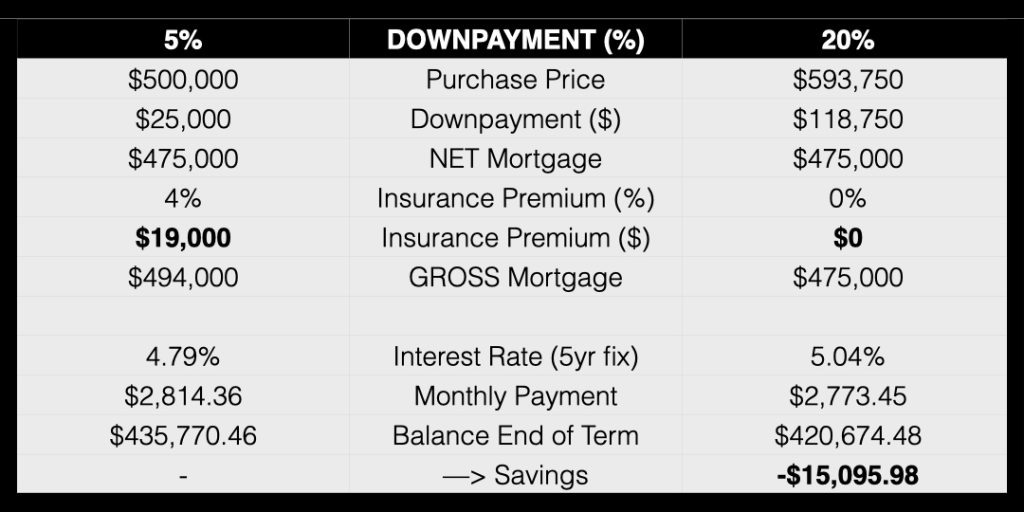

Many people think that the more money you put down, the better your interest rate will be – this is not entirely true. With the inclusion of mortgage default insurance, oftentimes the very best interest rates are granted to applicants who have down payments as small as 5%! You would think applicants with larger down payments would be rewarded with the best interest rates, but that is not the case. And here’s why -> mortgages with down payments less than 20% are subject to an insurance premium that gets tacked on to their mortgage principal. The insurance premium essentially makes the mortgage a risk-free investment (to the lender) – if the borrower defaults on the mortgage, the lender makes the claim and is refunded the outstanding mortgage principal. But here’s the kicker. The borrower pays for the insurance, not out of pocket, but through a direct equity hit when the premium is tacked on to the mortgage. When you factor in the immediate loss in equity, the lower interest rate loses its appeal. Insurance premiums are mandatory for all mortgages in Canada with down payments less than 20%. Here’s a comparison that shows the difference between a buyer with 5% down versus a buyer with 20% down, both with an identical mortgage principal balance of $475,000 (as of May 21, 2023 market rates):

Also worth noting is that mortgage default insurance premiums are tiered; as you increase your down payment, the premium decreases until you finally reach the 20% down payment threshold where insurance requirements cease. Click Here to be redirected to the insurance premium table of Canada Guaranty (one of Canada’s three mortgage default insurance providers).

Just as insurance premiums are tiered, so too are lenders’ interest rates. In the comparison table above, the interest rate for a mortgage with a 20% down payment is 5.04%, but many lenders offer deeper discounts with larger down payments. Unlike the assurance of mortgage default insurance, uninsured-mortgage lenders achieve a similar level of assurance when they reach a loan-to-value ratio of 65%. So, at 80% loan-to-value (20% down payment), the rate offered in the table above is 5.04%, but as the down payment increases, the lender decreases the interest rate further until they finally reach the 65% loan-to-value ratio at which point they match the insured-mortgage rate of 4.79%. It is at the 65% loan-to-value threshold that lenders feel they are virtually guaranteed a return of their principal in the event the borrower defaults. Essentially, if required, they feel that even in a weak market and/or economy they could sell the property at a substantial market discount and possibly even come out on top with a surplus profit.

Wondering how you can get the best possible mortgage rate? Call or text Marko Gelo right now at 604-800-9593, or Click Here to schedule a free, no-obligation phone call with Marko.

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text/WhatsApp | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email: gelo.m@mortgagecentre.com

@markogelo (Twitter)