(May 23, 2024)

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

As your mortgage approaches maturity, it’s important to assess your financial standing and plan accordingly for the next phase of your mortgage term.

This article provides suggestions on how to proceed with your mortgage renewal depending on your current financial comfort level. Whether you’re struggling to make ends meet, or maintaining your finances with ease (or anywhere in between), here are some pathways to consider at renewal time:

PROFILE 1: I’m struggling

- recast your mortgage to the maximum allowable amortization of 30 years. This will do wonders if you are unprepared to deal with your new rate and payment. For example, let’s say you have a $400,000 mortgage at 2.79% (5yr fixed) with a monthly payment of $1,851. Since you started with a 25 year amortization, your mortgage will renew based on the new rate and remaining amortization of the existing mortgage, 20 years. So, let’s say you renew to a fairly generic 5 yr fixed offering these days of 5.19%, your new 20-year amortized mortgage payment would equate to $2,273/month (adjusted to the renewed mortgage principle of ~$340,000). That’s an increase of $422/month. However, if you chose to expand your amortization to 30 years, your payment would increase to only $1,856/month (only a $5 increase!). If you don’t feel good about moving backwards with your mortgage amortization, remember that you can increase your payments and make lump sum payments towards your mortgage principal at any time, this allows you to get back on track when you are good and ready to do so.

- There are three tiers of lending and if you’ve damaged your credit rating and are unable to renew into top tier lending, don’t feel bad (you’re not the only one!). The 2nd tier of lending is a reasonable pathway. Yes, the rate is higher (about 1-1.5% higher), but the term is only 1 year. Enroll into mortgage rehab and get your financial situation sorted in time for a renewal back into tier-one lending in one years time. Think short term pain, long term gain.

- If you are over the age of 55, you can also consider the CHIP Reverse Mortgage. This mortgage essentially guarantees qualification and eliminates any sort of monthly payment obligation altogether (the payment is worked into the mortgage balance and pays itself). Depending on your age and the value of your property, you can refinance your mortgage and enable it to operate like a retirement fund with your own customized disbursements and timelines.

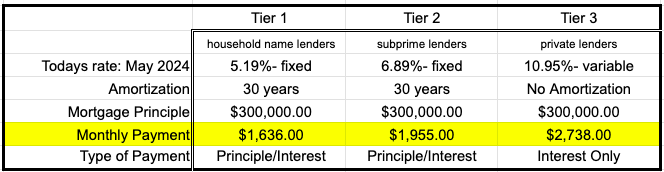

- And lastly, If all else fails, there is private lending. These are for extreme cases of hardship where you can no longer qualify with any lender due to either a severe hit to your credit score, or loss of employment. These mortgages are priced lower than a credit card, but higher than a personal line of credit and feature payments that are interest only. For example, here’s a table that contrasts the difference in monthly servicing costs on a $300,000 mortgage balance from all three tiers of lending:

PROFILE 2: I’m surviving, but could use a breather

- Just as above, don’t hesitate to recast your mortgage to a higher amortization. Most lenders allow up to 30 years, but ask for monthly payment scenarios and select the amortization expansion that best suits you (20, 25, 27 years, etc).

- Sometimes a good ‘ol debt consolidation is just what’s needed to give you that extra breathing room that you’re looking for. For example, let’s say you’re carrying a $550,000 mortgage with a $20,000 running balance on a personal line of credit and a dwindling $5,000 car loan. With the mortgage payment at $2,800/month, the line of credit at $600, and the car loan at $450, your total monthly outgoing cash flow totals $3,850. But let’s say you consolidate your debts into the mortgage and recast your amortization to 30 years, not only would you eliminate all your high interest debt and the monthly payments associated with them, but you would also reduce the overall outgoing cash flow total with your new singular mortgage payment of $3,200 (on your new mortgage principle $575,000). That’s a monthly savings of $550!

PROFILE 3: I’m managing just fine

If your financial health is intact, then it does essentially boil down to one of two things; get the best rate possible, and/or consider any of the following concept-driven mortgages:

- Interest Cancellation mortgage: structure your mortgage so that your income deposits directly into your mortgage principal while simultaneously functioning like a chequing account. The less you spend, the more you save, and the faster you pay off your mortgage. The powerful thing about this product is that your income deposits are immediately applied against the interest costs of the principal balance. Regardless of how long your income deposit remains elevated you can be rest assured that while it’s in the account, it’s negating interest charges. Over time, your mortgage principal decreases faster than in a standard amortized mortgage. The application process for this mortgage entails a few extra illustrations and disclosures to ensure this concept is the right fit for the applicant.

- the Tax Deductible mortgage: restructure your mortgage to create tax deductions while your monthly payments appreciate in your choice of investment product (ie mutual fund, stock/share, etc).

- the Hybrid-Hedge Mortgage: segmentize your mortgage principal by breaking it into two distinct mortgages; a fixed and a variable rate mortgage. This strategy, known as split-rate mortgage hedging, involves dividing your mortgage principal into fixed and variable rate components. It provides stability through the fixed rate while offering potential savings as the variable rate adjusts in response to the anticipated drop in Canada’s Prime Rate.

And lastly, be sure to ask your mortgage broker about cash back rewards that are offered by lenders to sway you over to them. Depending on the size of your mortgage, some lenders offer cash-backs up to $5,000 to renew with them. But also understand the terms and conditions of the cash back offer before you sign, some of them could be very restrictive and loaded with anti-exit locks (high break penalties, full repayment of original cash back, etc.).

DISCLAIMER: Before making any decisions based on the above recommendations, please reach out to me for a personalized discussion. Economic conditions, rates, and market trajectories can change rapidly, affecting the suitability of these suggestions. The sentences formed in this post are my opinions and are subject to change at anytime, without notice.

Is your mortgage coming due? Call or text Marko Gelo right now at 604-800-9593, or Click Here to schedule a free, no-obligation phone call with Marko. You can also call Marko on WhatsApp.

Download my amazing Mortgage App…it’s loaded with calculators and tonnes of useful information!

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Download my award winning Mortgage App on your phone

Email: gelo.m@mortgagecentre.com

@markogelo (Twitter)