(July 14, 2023)

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

If you are one of the 1.4 million business owners in Canada who received a Canada Emergency Business Account (CEBA) loan in 2020, it’s crucial to be aware that the deadline for loan forgiveness eligibility is quickly approaching. By December 31, the loans up to $40,000 can be eligible for a 25% forgiveness, while loans greater than $40,000 can be forgiven up to approximately 33%.

Loan Default and Interest Charges:

When December 31, 2023 arrives, if you are unable to pay 63-75% of your loan balance (depending on the loan size), your CEBA loan will fall into default, and interest charges will begin. Starting on January 1, 2024, you will be required to make interest-only payments until December 31, 2025, by which time the full balance of your loan must be paid.

Loan Forgiveness Calculation:

Let’s consider examples to illustrate the loan forgiveness calculation. If you have a CEBA Loan of $40,000, you would be eligible for $10,000 loan forgiveness if you pay $30,000 before December 31, 2023. Similarly, for a $60,000 loan, the forgiveness increases to $20,000 if you can pay $40,000 before December 31, 2023.

To summarize, repaying the outstanding balance of the loan (excluding the amount eligible for forgiveness) on or before December 31, 2023, will result in a single tranche of loan forgiveness of up to $20,000 based on a blended rate:

- 25% on the first $40,000

- 50% on amounts above $40,000 and up to $60,000

Seeking Financing Options:

If you are unable to repay your loan, it is highly recommended to seek some form of financing in order to pay the portion of your loan that makes you eligible for forgiveness. Allowing the entire balance to go into default should be avoided at all costs, as it would require you to repay the full loan amount without any forgiveness.

Consider Mortgage Refinance as Debt Consolidation:

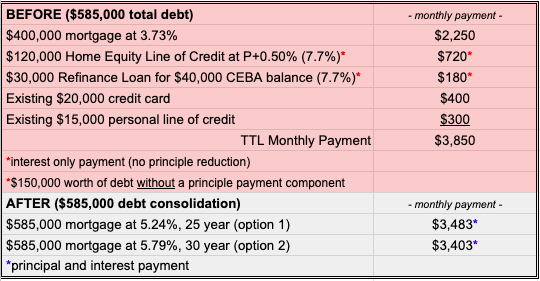

Similar to any other form of debt, a mortgage refinance has proven to be an excellent tool for debt consolidation. Mortgage refinancing offers lower interest rates compared to unsecured loans, along with more flexible repayment frequencies and amortizations. For instance, a $40,000 unsecured line of credit would require monthly payments ranging from $400 to $600. However, by consolidating the same amount into your mortgage at today’s rates of approximately 5.24%, your payment would be incorporated into your mortgage payment, amounting to around $240 per month. Additionally, you may also consider rolling any other existing debt you have into the mortgage consolidation, potentially reducing your overall monthly debt payment even further. Here is a before/after example of a mortgage refinance involving a CEBA loan and some existing debt:

Want to explore your mortgage refinance options? Call or text Marko Gelo right now at 604-800-9593, or Click Here to schedule a free, no-obligation phone call with Marko.

Don’t want to miss out on the next blog post? Click Here to have future issues emailed directly to your inbox!

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text/WhatsApp | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email: gelo.m@mortgagecentre.com

@markogelo (Twitter)