(September 19, 2022)

From a First Time Home Buyer Perspective

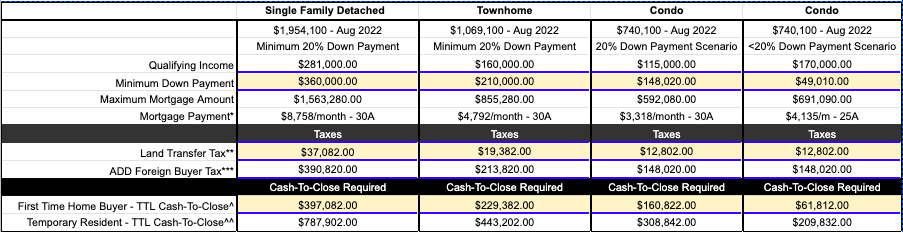

The minimum income required to purchase a property in Greater Vancouver is as follows:

- Single Family Detached Home: $281,000/year (individual or combined household gross income, before taxes)

- Townhome: $160,000/year (individual or combined household gross income, before taxes)

- Condo With 20% down payment: $115,000/year (individual or combined household gross income, before taxes)

- Condo With less than 20% down payment: $170,000/year (individual or combined household gross income, before taxes)

**the scenarios above are based on benchmark price statistics for August 2022 as reported by The Real Estate Board of Greater Vancouver. Detached Home Benchmark Price = $1,954,100, Townhome Benchmark Price = $1,069,100, and Condo Benchmark Price = $740,100. Qualification rates of 7.44% as of Sept 18, 2022 were used (5.49% contract rate plus 2% stress test)

After income qualification, the next biggest challenge for first time home buyers is satisfying the minimum down payment requirement for mortgage qualification, especially in high priced markets like Vancouver. Here is a summary of down payment requirements and how they apply to the Vancouver market:

- as of Aug 2022, the benchmark price for a detached home in Greater Vancouver is ~$1.8M. For homes greater than $1M, the minimum down payment for mortgage qualification in Canada is 20%. Therefore, regardless of whether you are a repeat home buyer or a first time home buyer, your minimum down payment for a benchmark detached home in Greater Vancouver will be $360,000

- however, for properties less than $1M, the down payment threshold decreases significantly as follows: 5% down payment up to $500,000, then 10% on the balance thereafter

- as of Aug 2022, the benchmark price for a condo in Greater Vancouver is ~$750,000. For a $750,000 condo purchase, the minimum down payment would be $50,000

- the benchmark price for a townhome in Vancouver sits at ~$1.05M. Therefore, the minimum down payment requirement would be $210,000

Unlike Alberta, British Columbia has a substantially different Property Transfer Tax regime that is due at the time you purchase a resale property. If you are a first time home buyer and purchase a property under $500,000, you are exempt from paying the Property Transfer Tax. The exemption is then scaled once you surpass a $500,000 purchase price up to $525,000. The tax is calculated as follows:

- 1% of the fair market value up to and including $200,000, then

- 2% of the fair market value greater than $200,000 and up to and including $2,000,000

- the property transfer tax continues to scale upward as you approach higher purchase thresholds, Click Here to read about the complete details and tiers

From a Temporary Resident Perspective (work permit holders)

- All the same income and down payment thresholds apply for temporary residents just as they do for standard Canadians or Permanent Residents. The only difference is that temporary residents are able to provide alternate sources of credit verification if they haven’t yet been able to establish a standard 2 year credit history. For example, if a Temporary Resident is not able to provide a 2 year history of credit usage in Canada, they can alternatively provide a letter of good standing from their bank from where they departed. This is just one example, there are many other forms of alternative credit verification sources (call Marko right now and ask him!)

- In addition to British Columbia’s Property Transfer Tax described above, the 20% Foreign Buyer Tax is also applied to the gross purchase price of a property. This is a major deterrent for temporary residents in Greater Vancouver (and throughout other popular regions in BC). Temporary resident applicants either decide to wait it out until they attain their Permanent Residence at which time they are no longer required to pay the Foreign Buyer Tax, or they relocate to other parts of the country where the Foreign Buyer Tax is not applicable (foreign buyer tax does not apply in cities such as Calgary, Edmonton, Halifax and Montreal)

From a Baby Boomer Perspective

- British Columbia is increasingly becoming a primary retirement destination of Canadians. Canadians from afar continue to make their way to the Okanagan, Lower Mainland and Vancouver Island regions. Other than the price of real estate, the only other transactional item to be aware of is the Property Transfer Tax (as mentioned above

- Another popular program available for BC residents aged 55 and older is the Property Tax Deferment program – this allows eligible applicants to defer on their annual property tax bill and simply let it accumulate on their land title as an outstanding charge that will become payable at the time the property is sold (click here for more details)

- Applicants aged 55 and older are also eligible to purchase a property with a CHIP Reverse Mortgage (this allows the applicant to qualify for a mortgage with a minimal income and does not require any payments to service the mortgage throughout). Contact Marko right now to learn more about Reverse Mortgages, or Click Here to schedule a call with him!

- Baby Boomers are often eligible for Net Worth Qualification mortgages. These mortgage qualifications are for applicants who declare a low qualifying income, but are able to boost their qualification on a dollar for dollar basis with their liquid assets. For example, if an applicant earns $20,000 per year, they would only qualify for a mortgage of ~$50,000. But if they have liquid assets of at least $250,000, their mortgage qualification would increase to $300,000! Click Here to be redirected to a past blog on High Net Worth mortgage qualification.

- also worth noting is that in BC you are able to use the services of a Notary for your real estate transaction (in addition to or instead of a lawyer)

RELATED ARTICLES:

I arrived in Canada and want to buy a house!

Qualifying for a mortgage when relocating to another province

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text/WhatsApp | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email Me: gelo.m@mortgagecentre.com

@markogelo (Twitter)