(October 2, 2022)

Cost of Borrowing vs Falling Home Prices

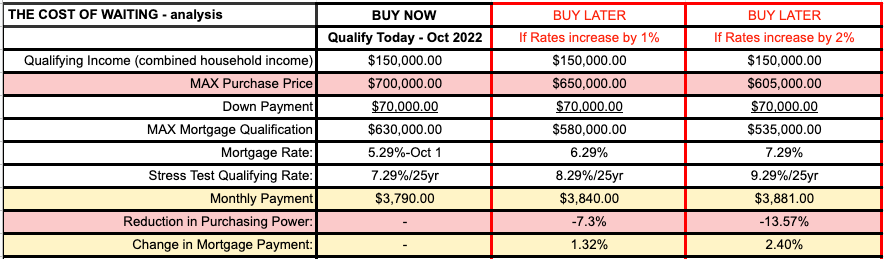

It’s tough enough to be in the midst of a volatile real estate market, but to add to it a rising inflationary and interest rate environment many Canadians are finding themselves contemplating their next move. Buy now and lose out on future market corrections, or hold off for further price drops and miss out on prevailing interest rates before they rise further. The argument is ongoing and the answer varies depending on the unique circumstances of the buyer, where they are located, and the various market drivers currently at play.

What makes today’s environment especially challenging is the rapidly (and almost daily) changing interest rate hikes and the wait and see impact on home prices. For many, the outcome seems obvious that the housing market will plummet, but others aren’t so quick to jump to the same conclusion. With record-setting immigration, volatile inter-provincial migration swings and complex economic fundamentals, many prospective home buyers are looking at it from another angle. What if rates continue upward, but real estate prices remain where they are (or only change marginally)?

So this brings us back to the question, should I buy now (when you have the highest purchasing power), or bank on prices moving further downward and wait it out?

It is well known that Canada’s real estate market is broad and exceptionally diverse when you compare how far a $150,000 household income will go in various markets across Canada (ie. purchase a 900-1000 sq ft condo in Vancouver, or a 3-4 bedroom 2500 sq ft home in Calgary). But when it comes to mortgage rates, there is no regionally-linked pricing variation – the property owner in Calgary gets the same interest rate as does the Vancouver homeowner regardless of the substantial gap in housing affordability.

Wondering how much it will cost YOU to wait? Call Marko Gelo right now at 604-800-9593, or Click Here to schedule a call that is convenient for you.

RELATED ARTICLES:

Moving to Vancouver? Here’s what you need to know when it comes to qualifying for a mortgage

Options for variable rate mortgage holders with trigger rates and trigger points

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text/WhatsApp | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email Me: gelo.m@mortgagecentre.com

@markogelo (Twitter)