(October 15, 2022)

There’s more to a rate hold than the actual rate itself

For most prospective homebuyers the concept of reserving an interest rate seems simple enough. Complete a mortgage application, consent to a credit check, provide a few verification documents and off you go, right? Not so fast.

What everyone is overlooking these days is the impact that the actual rate (and term) has on your overall mortgage qualification. There are plenty of terms and conditions that may not appear obvious to you or just simply haven’t been disclosed to you up front. The 90 or 120 day rate guarantee that you receive goes without saying, almost every lender offers a rate hold, but there’s more to a rate hold than the actual rate.

Here are some other rate hold characteristics to be aware of:

*not all rates and terms are eligible to be held.

*Almost all lenders have a 5yr fixed rate that is eligible for rate holds, but other terms may be restricted. Inquire with your mortgage broker about different terms that are eligible for holds.some lenders tack on a premium for holding a rate. For example, if a rate for a 5 year fixed is advertised as 4.59%, the rate hold could include a 10 bps premium, thereby securing the rate for 4.69%

*although prime rate cannot be held, the discounts associated with variable rate mortgages are certainly eligible for rate holds up to 120 days. For example, for a Prime – 0.90% variable rate mortgage offer, the Prime Rate component of the product is variable and cannot be reserved, but the 0.90% discount is fixed throughout the entire term and can be held for up to 4 months with most lenders

*if rates decrease within your rate hold period, you must request to be adjusted to the lower rate. IT DOES NOT happen automatically. This type of rate management varies with lenders and how they manage their rate hold portfolios. Inquire directly with your mortgage broker to find out how they manage their rate holds.in an increasing rate environment a rate hold becomes even more critical. Not only is your rate secured, but so is your mortgage qualification amount. Interest rates and mortgage qualification amounts have an inverse relationship – the higher the rate goes, the lower your qualification amount. It is important to note that some interest rates will yield a higher qualification amount than others.be aware that most 30 year amortized rates are higher than 25 year amortized rates. Ask for clarity about your rate hold, is it a 25 year amortized rate, or a 30 year amortized rate? This is a critical decision that could result in a substantially lower mortgage qualification amount (if you unknowingly committed to a 25 year amortized rate versus a 30 year amortized rate)

*Categorized mortgage rates are often not eligible for rate holds. One such category of interest rates that are typically not eligible for rate holds are pricing bands that are categorized by loan-to-value (LTV) ratios. The most competitively priced interest rates are available at loan-to-value ratios greater than 80% and below 65%. For example, one of Canada’s top lenders are offering 5 year fixed rates ranging from 4.84% to 5.04% as per the following loan-to-value thresholds:

- greater than 80% LTV (less than 20% down payment): 4.84% (mostly eligible for rate holds)

- 75.01% to 80% LTV (20% to 24.99% down payment): 5.04% (typically not eligible for rate holds)

- 70.01% to 75% LTV (25% to 29.99% down payment): 4.99% (typically not eligible for rate holds)

- 65.01% to 70% LTV (30% to 34.99% down payment): 4.99% (typically not eligible for rate holds)

- up to 65% LTV (greater than or equal to 35% down payment): 4.84% (typically not eligible for rate holds)

- **the interest rates above are as per October 10, 2022. Inquire directly to Marko Gelo for the most up-to-date interest rates.

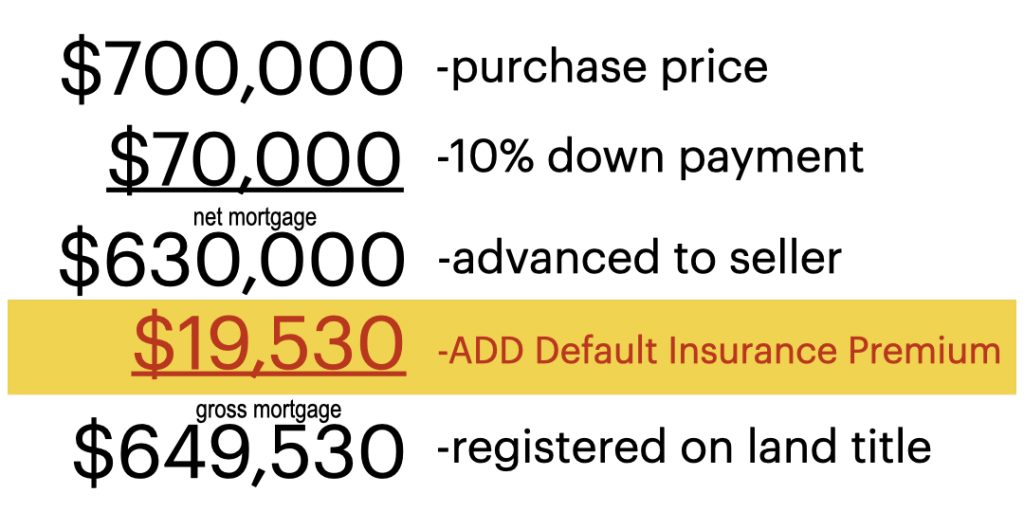

- **SIDE NOTE: insured mortgages (less than 20% down payment) offer the best rates as they are protected against default. These mortgages are a low risk proposition to lenders as they are protected via the insured component (CMHC, SAGEN, Canada Guaranty) of the mortgage…if the borrower defaults on their payments and digresses further into foreclosure, the lender doesn’t lose a dime as the insurance pays out. Furthermore, it is the homeowner that purchases the insurance (not the lender!). Although this bracket yields the lowest interest rates, it doesn’t come without a cost. Insurance premiums are added to your mortgage at the time you purchase a property, thereby having an immediate impact on your equity (reducing it). Here’s how a $700,000 purchase with a 10% would look like when factoring in the insurance premium:

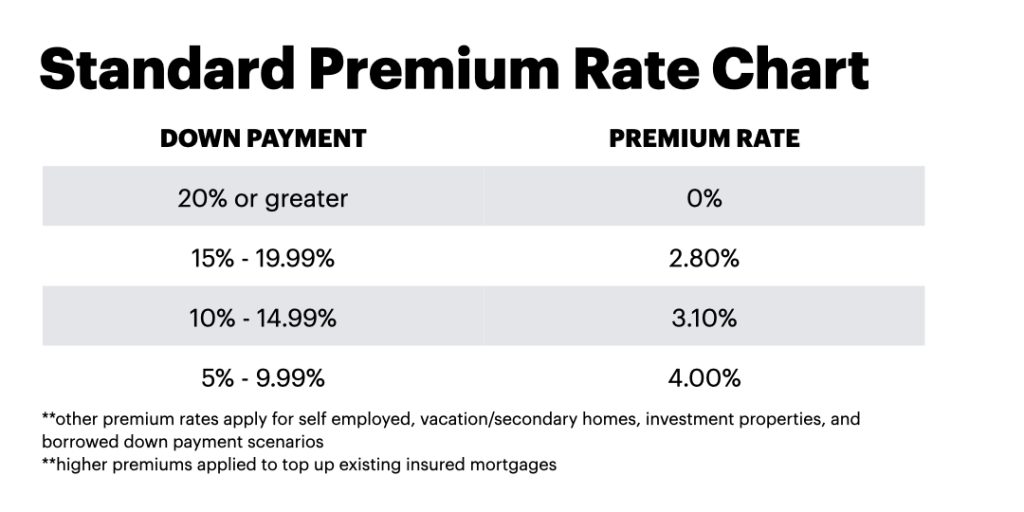

The following table outlines the various insurance premium tiers for purchase transactions:

Looking to secure the right rate for yourself? Call Marko Gelo right now at 604-800-9593, or Click Here to schedule a call that is convenient for you.

RECENT ARTICLES:

Should I buy a house now, or later?

Moving to Vancouver? Here’s what you need to know when it comes to qualifying for a mortgage

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text/WhatsApp | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email Me: gelo.m@mortgagecentre.com

@markogelo (Twitter)