(June 19, 2021)

Intro (pre-amble): up to 11:45 mark of podcast

With over 300,000 new residents arriving to Canada (and about 400,000 expected on an annual basis for the next 2-4 years), Canada’s banks have been continuously altering and modifying their lending guidelines to accommodate for immigrant-friendly mortgage qualification programs.

Today, I want to talk about mortgage qualification for temporary residents, particularly for work permit holders.

What is a Temporary Resident?

Directly from the Government of Canada’s website:”A temporary resident is a foreign national who is legally authorized to enter Canada for temporary purposes. A foreign national has temporary resident status when they have been found to meet the requirements of the legislation to enter and/or remain in Canada as a visitor, student, worker or temporary resident permit holder. Only foreign nationals physically in Canada hold temporary resident status.”

So basically, a Temporary Resident is the first step to becoming a Canadian Citizen…but also, it could simply just be a temporary stay in Canada with special privileges to either work, study or live for an extended and/or temporary amount of time. If you eventually intend to become a Canadian citizen, the next step is to apply for your Permanent Residence card, and then finally, after fulfilling a few game-show-like criteria you eventually become an official Canadian citizen! In a best case scenario it could take you 1,095 days (3 years) to become a Canadian citizen as they graduate from Temporary Resident to Permanent Resident, and finally Canadian citizenship.

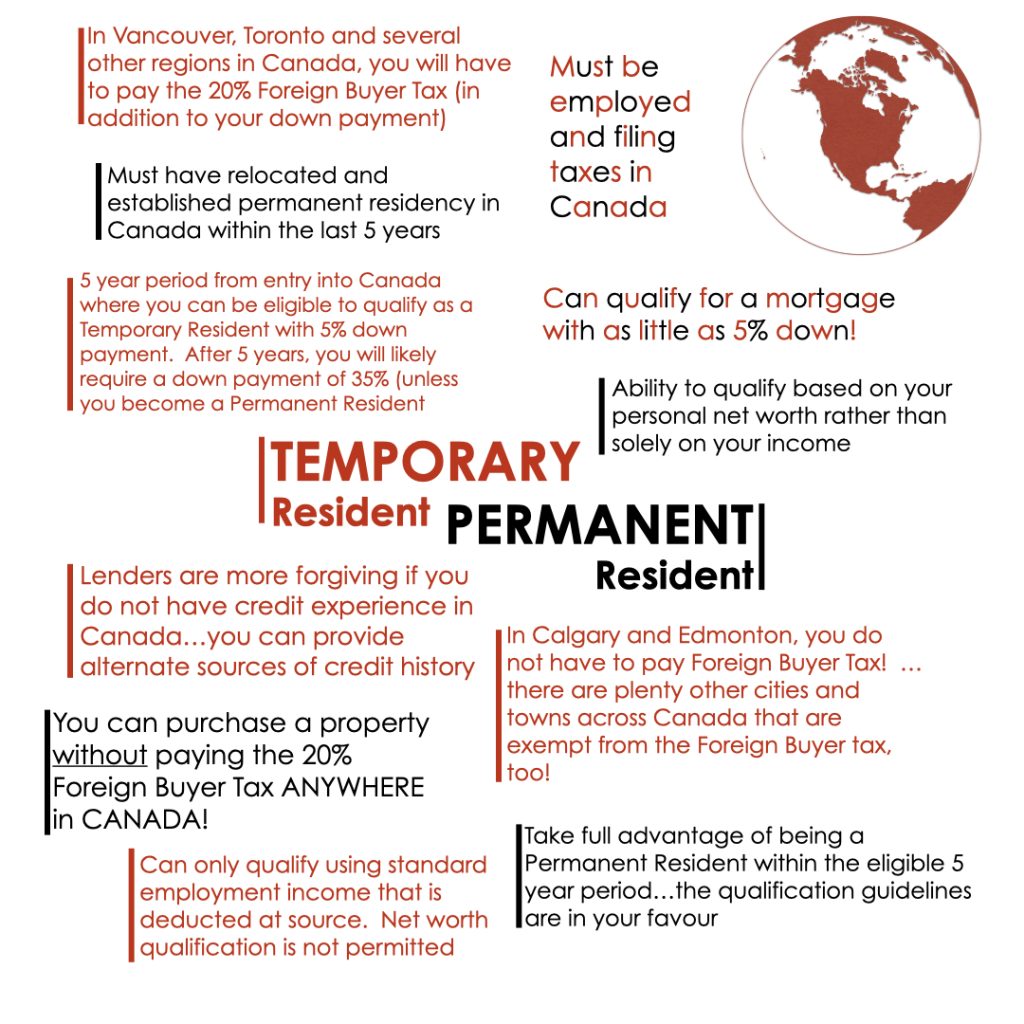

However, when it comes to purchasing a property, Temporary Residence status is all you need…that means as long as you have a work permit, and have been employed for at least 3 months, you are eligible to qualify for a mortgage to purchase a home.

Here are the key requirements for the Temporary Resident Mortgage program:

- must have a valid Canadian Employment Authorization For (Work Permit) OR letter from the current Canadian employer confirming exemption from the requirement to obtain a work permit

- the work permit or exemption letter must have been issued for a minimum period of one year, and the time remaining as at the application date must be six months or longer

- may not own any other real estate in Canada; this also applies to additional applicants and/or spouses who are not on the application

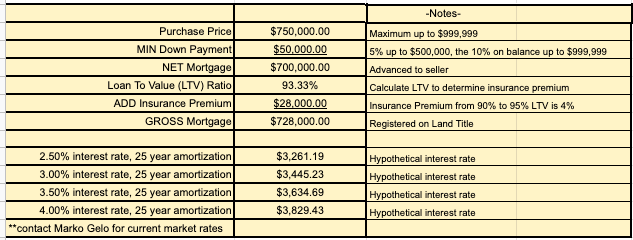

- minimum down payment: 5% up to the first $500,000, then 10% on the remaining balance up to $999,999.99. For Purchase Prices that are $1M or greater, the minimum down payment requirement is 20%

- the window of opportunity to qualify as a Temporary Resident is only within a 5 year period of the applicants entry into Canada (to be confirmed with a copy of the passport showing the entry date to Canada)

- if applicant remains as a Temporary resident following the 5 year period, they are no longer eligible under the Temporary Resident mortgage program and must now wait until they have been granted Permanent Residence

- and finally, the most defining guideline of the Temporary Resident Mortgage program is the allowance of alternative sources/forms of credit verification. Up until this point, all the mortgage qualification criteria is pretty much identical to what a Canadian citizen would experience except for an exception granted to newcomers who may not yet have established the minimum credit requirement standard that all Canadian citizen applicants are held to (2 credit facilities with $2,000 limits for a minimum of 2 years). If the newcomer cannot comply with the minimum credit requirement standard, then the following alternative verifications are accepted:

- An international credit report demonstrating a strong credit profile, or

- TWO (2) alternative sources of credit demonstrating timely payments (no arrears) for the past 12 months. The two alternative sources required are:

- Rental payment history confirmed via letter from a landlord and bank statements to further confirm the payments being withdrawn from your bank account, and

- One other alternative source (hydro/utilities, telephone, TV cable, cell phone, auto insurance, etc) to be confirmed via letter from the service provider or 12 months billing statements

And that’s it, the true essence of the Temporary Resident program is simply the exception granted to the newcomer when it comes to creditworthiness guidelines…the newcomer gets a bit of a break here in that other sources are looked upon to demonstrate credit worthiness rather than the typical credit cards, lines of credits and car loan type of verification documents. But as far as the rest of the mortgage qualifying criteria goes (debt servicing ratios, minimum down payment requirements, income confirmation and so on), the Temporary Resident is pretty much on the same playing field as a Canadian citizen is when it comes to qualifying for a mortgage. But, it is definitely in the newcomers best interest to acquire Canadian credit products as soon as possible because if the 5 year eligibility period passes (for the Temporary Resident mortgage program), lenders will be far more demanding and less likely to grant the applicant an exception as they would then deem the applicant on par with a standard Canadian citizen applicant, therefore, they would expect the minimum credit requirement standard that all Canadian citizen applicants are bound by (2 credit facilities with $2,000 limits for a minimum of 2 years)

**For more information, Click Here to be redirected to the Government of Canada’s Immigration and Citizenship guidelines and procedures.

OTHER RELATED ARTICLES:

Qualifying for a mortgage as a BC Provincial Nominee

The First Time Home Buyer Kit for New Canadians (permanent and temporary residents)

Contact Marko, he’s a Mortgage Broker!

604-800-9593 direct Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 direct Calgary (Click Here to schedule a call with Marko!)

markogelo.com

Facebook

@markogelo (Twitter)

MarkoMusic (SoundCloud Account)…all podcast music tracks are performed and produced by Marko