We’ve basically told Vancouver’s real estate market, “You’re Grounded”

It all began with a few minor mortgage rule changes about 10 years ago. But, little by little we went from qualifying for a mortgage using a 40 year amortization and loosely bound approvals to where we are today:

Sometimes grounding, doesn’t work

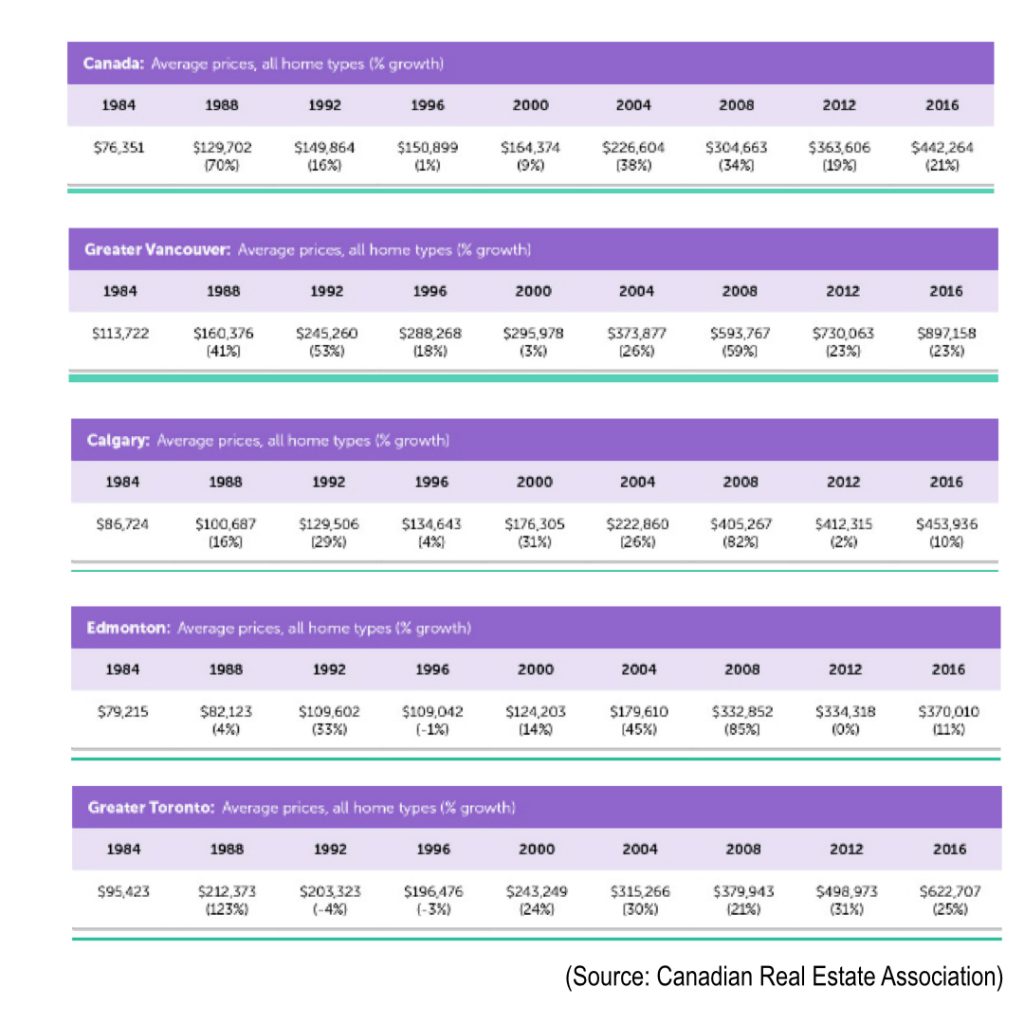

Since the implementation of the mortgage rules in 2008, the average price in Canada’s major cities have steadily increased (to varying degrees, of course) all along up until 2017. (Note: interest rates were ridiculously low during this time) And so far, 2018 is starting to show some corrections in Vancouver and Toronto. (Note: interest rates are still, pretty much, ridiculously low at this time) But really, nothing outrageous is playing out…Vancouver is a little less in crisis mode, but definitely still (extremely) unaffordable. (Note: because interest rates are still, pretty much, ridiculously low) For instance, in North Vancouver, the going rate for a 1950 post war era 1000 sq ft bungalow is ~$1.1-1.8 M…and that’s a corrected/softened (or whatever you wanna call it) price. The idea was to curb the demand, but what really ended up happening was the supply side started tightening up even more. Fewer home owners are listing their homes for sale probably for fear of what to do, thereafter, if they sell.

If we are to learn from (recent) history, then what are we to conclude from these figures…(HINT: mortgage rule changes don’t address affordability issues):

Wait, there’s more…ugh

On top of altering mortgage qualification rules, the provincial government of BC insisted on their new housing tax policies; foreign buyers tax, speculation tax (aka vacancy tax), and increased/revised property transfer and school tax rates on homes over $3 Million. From these policies they expect to suck about $1.3B from British Columbians’ and investing outsiders’ pockets. Here’s the thing though…none of these taxes will affect the average resident who owns a home, resides in it, works, and plays/lives in Vancouver (and surrounding area). This would be the demographic that own homes that would likely be considered, affordable, if they were to list them for sale. Will these new tax policies reeeaaally have a downward impact on the average real estate price in Vancouver? Will it in turn ease the rental market crisis (by flooding the market with upscale West Vancouver rental suites)?

So, with no (serious) modelling projections from the BC government…I guess we kinda just wait and see how it all shakes down, right? Ugh, actually…yes. That is precisely the game plan – we’ll just have to wait, then see.

You really want affordability? Pray for rate increases.

It’s rising interest rates that will drive Mr. and Mrs. Paycheque-to-Paycheque (P2P) to maybe list their Vancouver home for sale. And that’s only a maybe, considering a purchase in the last 10 or so years (when Vancouver real estate really started to hit the stratosphere) would almost certainly guarantee that you have been carrying a super-sized mortgage with a probable save-the-day-refinance-booster injected at one point, thereby, nullifying any principle pay down over the term up to present time. Even then, unless Mr. and Mrs. P2P and their growing family sought a means out of their financial woes by throwing in the towel and selling their $1M 1973 Vancouver Special, they probably still wouldn’t list it. Why? Because what are their options for the transition to the next purchase? A +$1.4M upgrader 3 bedroom, tear down?

US Tax Policy changes, NAFTA negotiations, oil pipelines, elections, coalitions, immigration, foreign tax, empty house tax, property transfer tax, carbon tax, trade wars, easing of stimulus, minimum wage…quite a few things at play that could potentially affect Canada’s interest rate environment. All indicators pointing to a sustained and gradual rise. And as indicated by the recent Bank of Canada interest rate announcement, no movement on prime rate until, perhaps, later in the year.

So as is the case with the tax policies, it’s wait and see. Except, with rising interest rates no model projections required – the outcome will be obvious. Any affordability gains will be offset by limited and sustained supply.

The alternative, and solution.

Rezone and conquer…too little land to service growing demand

If you would like to chat more, don’t hesitate to reach out to me directly. Thanks for reading and visiting the site. MG