(March 15, 2022)

Intro (pre-amble): up to 5:53 mark of podcast (weekly interest rate recap and projections)

One of the more common questions regarding pre-approvals is, “how long is my pre-approval good for?”. Generally speaking, a pre-approval is good for as long as the maturity date of the rate hold (as specified within the pre-approval). Rate holds are typically set for 90 to 120 days depending on the lender. Although the rate hold is indeed a critical part of the pre-approval, it can also be a major distraction from other more important (or critical) conditions that if not maintained (or updated) will lead to a significantly downgraded level of assurance, or outright invalid pre-approval. If any of the application details change from the date the application was completed, then the pre-approval could technically be deemed void and/or invalid.

Other than the rate hold guarantee in a pre-approval, here are some other conditions/circumstances to be aware of that could lead to your PA no longer being valid:

- lenders will require updated documents if they are dated greater than 30 days from the date your application goes live, this applies to the following: pay stubs, employment letters, credit reports, and down payment verification documents

- remember, your pre-approval is based on your application details and disclosures as captured on the specific date that it was completed. For example, if your credit card balance was $3,865 the day you got pre-approved, it should (at the very least) remain that way all the way until the completion date of your purchase. If the balance sneaks higher, the pre-approval is technically no longer valid.

- property selection can also lead to unexpected consequences. For example, if you secure an offer on a property that has special designations on the land title, your lender selection could suddenly be reduced to a select few. This may in turn result in a revised interest rate and increased qualification criteria.

- and lastly, inaccurate disclosures made in your pre-approval application will definitely become exposed when your application becomes live. This could ultimately lead to deal-breaking consequences. Here are some examples of inaccurate (or incomplete) disclosures: down payment proceeds are from borrowed sources rather than from own sources, the property will be rented out rather than owner occupied, iaccurate declaration of marital status (i.e. if applicant is divorced and has not yet disclosed so, the lender will suddenly request the separation agreement and re-adjudicate the pre-approval to account for any spousal or child support payment obligations – this will in turn have a significant impact on the overall pre-approval)

In summary, pre-approvals require ongoing updating from both the mortgage broker and the applicant. It is important to be proactive and diligent with your pre-approval. Be accountable and keep your mortgage broker informed of any changes to your overall application. This could include simple things such as reporting incremental pay increases or revised plans for a slightly lower down payment, but can also include more revealing and detrimental updates like incurring more consumer debt or perhaps the update is positive and is an opportunity to increase your qualifying mortgage amount. Regardless of the update, the pre-approval will ultimately need to be revised to account for the change. Whatever you do, DO NOT leave it to chance that your mortgage broker will regularly follow up with you as pre-approval’s are generally a one-time issuance. Keep in mind that live applications are naturally prioritized ahead of pre-approvals and as such it’s important to maintain full accountability for the validity of your pre-approval. If you are indeed going to be moving forward with a purchase, maintain communication with your mortgage broker. All it takes is a simple email or text to notify your mortgage broker that you are still engaged. This will trigger your mortgage broker to review your file and react accordingly with any information or document requests to keep your pre-approval is up-to-date.

A proper pre-approval should include qualification scenarios as well as any conditions, restrictions, or limitations pertaining to it. Pre-approval’s should be loaded with details, figures, conditions, and disclosures and should range in word count from at least 300 words to as high as 500-600 words.

Below are examples of a Rate Hold Pre Approval followed by a Fully Qualified Mortgage Pre Approval.

Example of a Rate Hold Pre Approval: (limited/miscellaneous details)

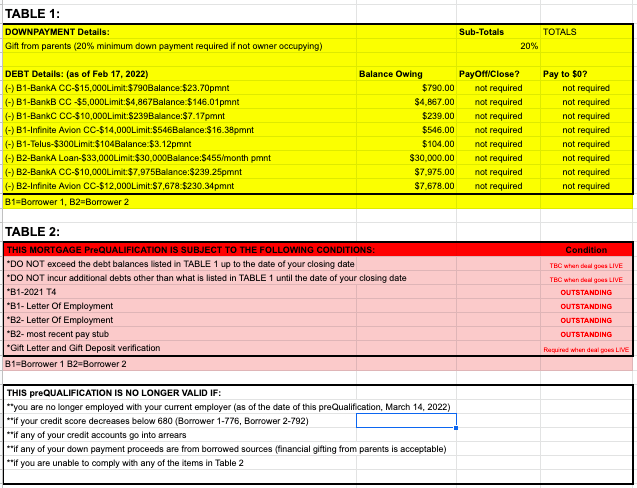

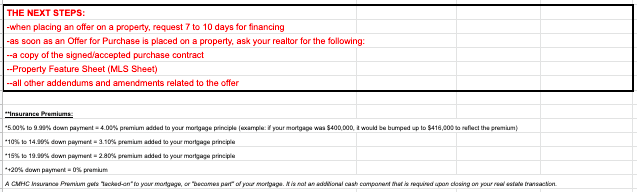

Here is a recently completed Fully Qualified Mortgage Pre Approval: (extensive details and scenarios)

OTHER RELATED ARTICLES:

How to get a bullet-proof mortgage pre-approval

The key driver for all mortgage approvals

8 powertips for first time home buyers

Contact Marko, he’s a Mortgage Broker!

604-800-9593 direct Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 direct Calgary (Click Here to schedule a call with Marko!)

@markogelo (Twitter)