(June 18, 2022)

Navigating your way through Canada’s real estate market has been anything but a walk in the park these days. With rising interest rates and heightened inflation, securing a real estate purchase with a mortgage has become a daring venture for some. But for many it’s business as usual albeit with some additional caveats and due diligence. The current economic environment is obviously under stress leaving many to wonder how this will affect their plans to purchase a property. For the moment, much of the stress is being directed on property values with varying impacts depending on which city or province you reside in.

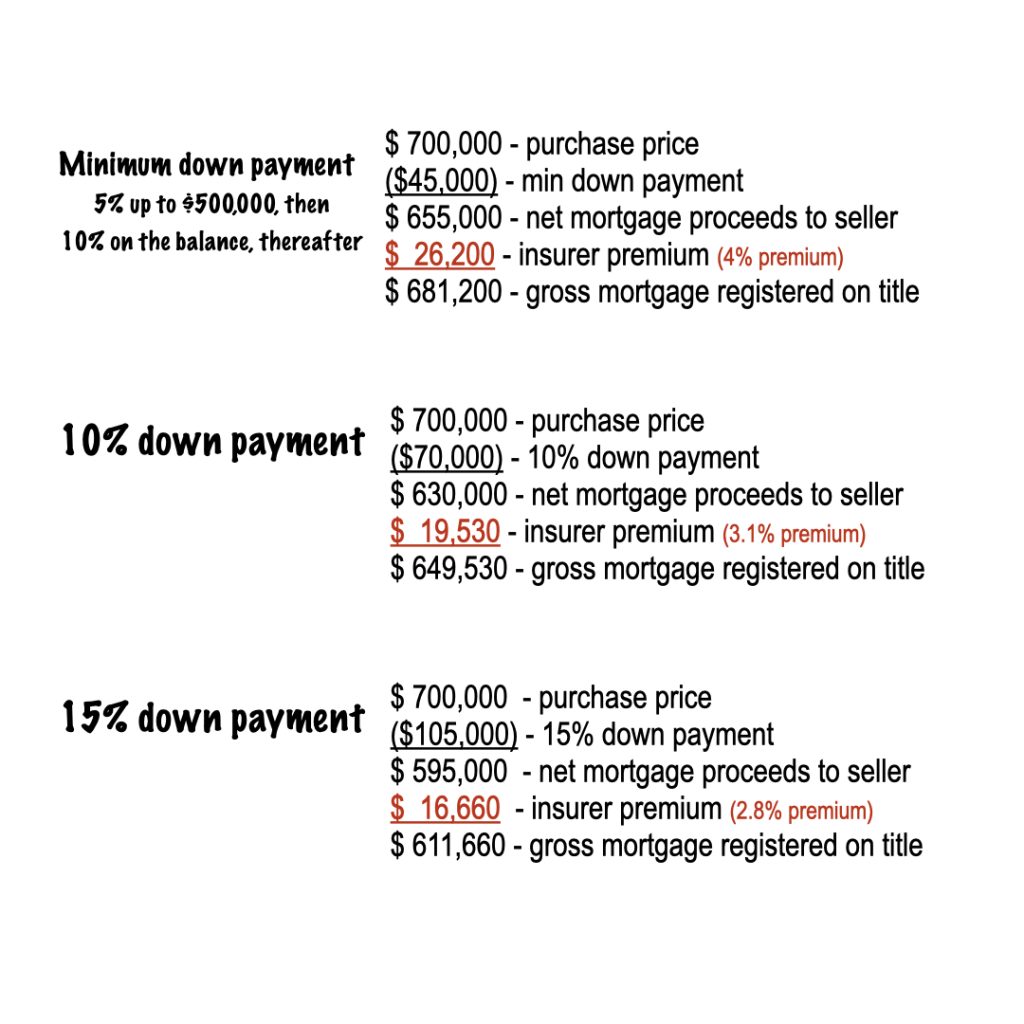

When it comes to mortgage qualification, this has resulted in a more critical analysis of the property appraisal. For starters, it’s important to be aware if an appraisal will even be required when you place a bid on a property. Generally speaking, if you are purchasing a property with a down payment of less than 20% your mortgage is deemed insured which ultimately means you shouldn’t expect a request for an appraisal from the lender. An insured mortgage protects the lender against default in the event you are unable to continue your mortgage payments…interest rates are often lowest in this category as a result. The lenders enjoy the blanket of their newly insured security further by the assurance that they will be paid out based on the mortgage amount, not the market value. This is why appraisals are not required when purchasing with less than a 20% downpayment. However, when it’s all said and done it’s important to recognize that the home owner/buyer is the one bearing the cost for the insurance premium (tacked on to your mortgage principle). Most homebuyers are unbothered with the equity hit brought about by the insurance premium as it is the only means to purchase a property with less than 20% down payment in Canada:

But when it comes to uninsured mortgages (mortgages for properties with down payments of 20% or greater), lenders will almost always request an appraisal as the mortgage will not be insured. Lenders are generally comfortable with your 20%-skin-in-the-game contribution, but will initiate further due diligence with the request for an appraisal.

And here is where you have to be aware of the potential impact of an appraisal, especially as it relates to your mortgage qualification.

What happens if the appraised value is lower than your purchase contract offer?

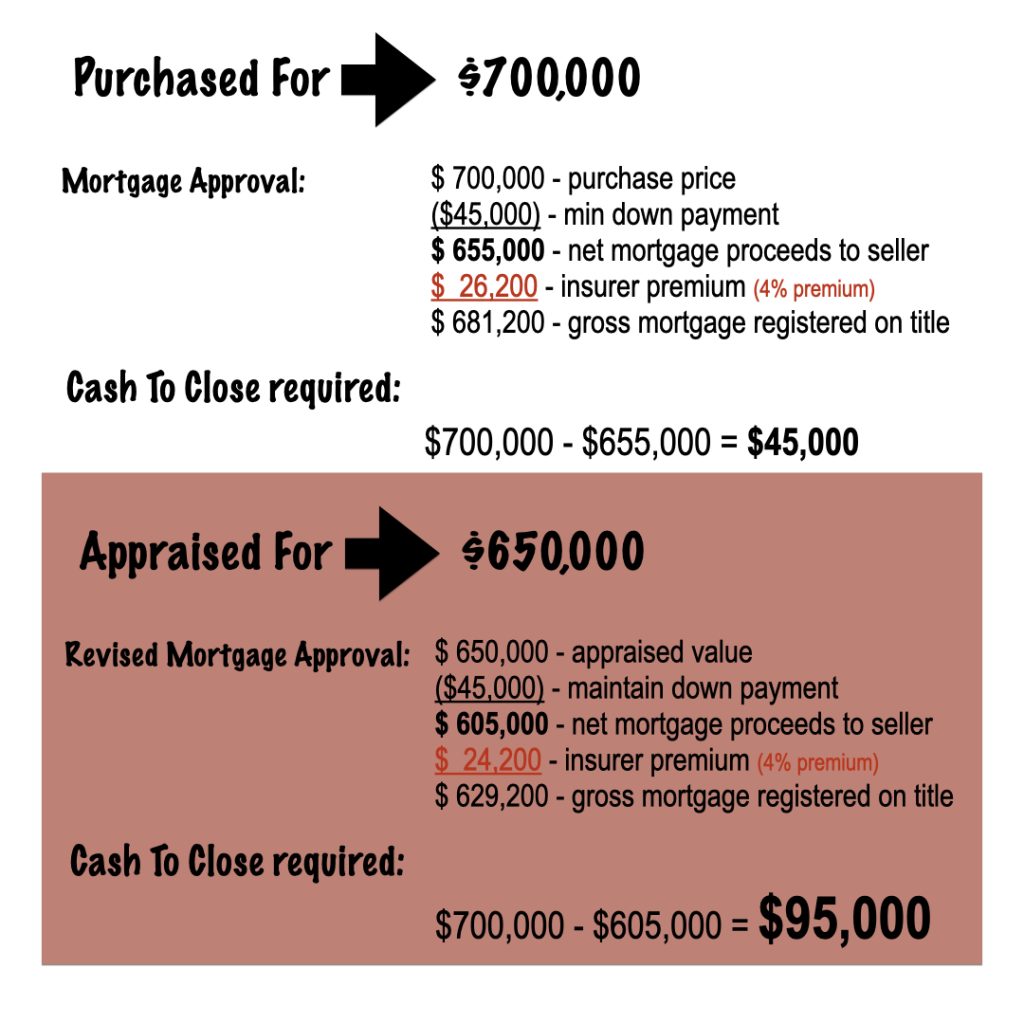

As far as your mortgage goes, it still remains approved. It is only the mortgage amount that changes as it decreases proportionally to your loan-to-value (LTV) ratio. Here’s an example that explains the impact of a lower appraised value for a mortgage that was approved with a minimum down payment of $45,000 on a $700,000 purchase (5% down payment up to $500,000, then 10% on the balance, thereafter):

As you can see, the impact is quite serious. To proceed with the purchase, the home buyer would have to make up the shortfall with their own resources as they would not be able to lever up their mortgage qualification further as they are already qualifying at the highest possible LTV ratio (minimal down payment).

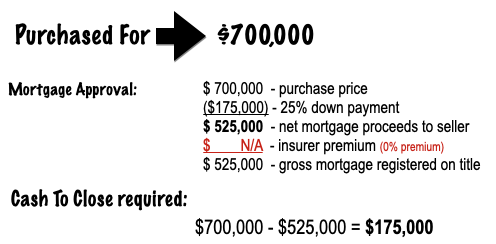

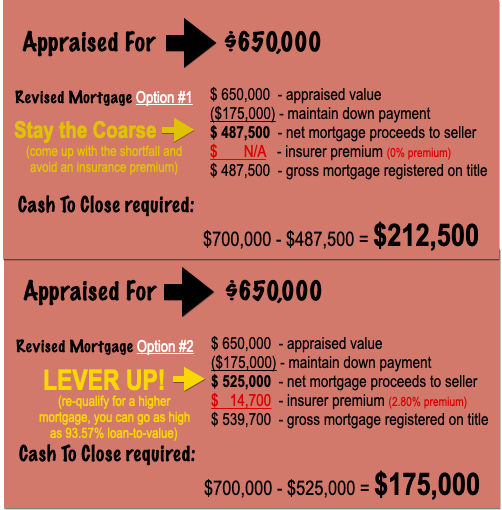

However, if your down payment exceeds the minimal requirements you may be safe as you can simply increase your mortgage amount further to account for the shortfall (provided you qualify for the increase in mortgage). Here is an example of a $700,000 purchase with a 25% down payment (75% LTV ratio):

From the examples above, one can conclude that simply levering up a mortgage to a higher loan to value ratio is enough to salvage the deal. This is correct, but be aware that levering up your loan-to-value ratio is a delicate procedure as there are three defining LTV zones; insured, insurable, and uninsured. The levering up technique is predictable and manageable when levering up within the same LTV zone. However, levering up from one LTV zone and into another zone is not so simple as qualification criteria changes significantly from zone to zone which ultimately leads to re-adjudication of your entire mortgage approval. Basically, you would be starting over with your mortgage approval and re-applying to a different qualification program or an entirely different lender.

If you are in a situation similar to what is described above, or anticipating you might be, contact Marko Gelo to discuss your options.

RECENT BLOGS:

Inter Family Real Estate Transactions & Gifted Equity

Are employment probationary periods deal killers?

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text/WhatsApp | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email Me: gelo.m@mortgagecentre.com

@markogelo (Twitter)