Click Here to be redirected to an updated blog post (September 25, 2023) on Mortgage Programs for Doctors who are in the process of completing or have recently completed their residency/fellowship.

(May 17, 2022)

Everyone knows that doctors produce solid incomes, but the path to get there isn’t a walk in the park. Not until they complete their 4-5 year medical school and 2-5 year residency programs do they begin to see the fruits of their labour. This could all amount to 10 years or even longer depending on their choice of specialty. And then on top of that there’s the costly student loans that have accumulated over the years. Becoming a doctor is a journey, and it’s expensive.

It is when a doctor begins their residency program when they finally start earning an income, and like all professions, it starts small and increases over time. Except for doctors, it could significantly increase over time. Recognizing the hockey stick-like income trajectory, a few of Canada’s lenders have created mortgages that are exclusive to Doctors who are just starting their residency programs.

The key feature of this unique qualification program is that it recognizes that a residency income is not reflective of the near term, end game income for the profession. For example, a 1st year medical resident in BC starts with an annual salary of ~$58,000 and as they progress through the program (usually up to 5 years), they eventually graduate into the coveted higher 6-figure income range (by the time their residency is completed). So for mortgage qualification purposes, eligible lenders will allow a first year medical resident (earning $58,000/yr) to use a projected qualifying annual income of $185,000 to qualify for a mortgage. This is significant as it immediately propels the medical residents purchasing power and also provides ample cushion to account for (from a mortgage qualification standpoint) any debt burdens that have accumulated over the years. To put this into perspective, an annual income of $58,000 will amount to a maximum mortgage qualification of about $270,000. But under the Projected Income Medical Residents program, that same $58,000 medical resident applicant can qualify for a mortgage of up to $900,000 using an eligible projected income of $185,000. **these qualification amounts are based on qualification rates at the time this post was published (May 2022). Contact Marko Gelo directly for current qualification scenarios.

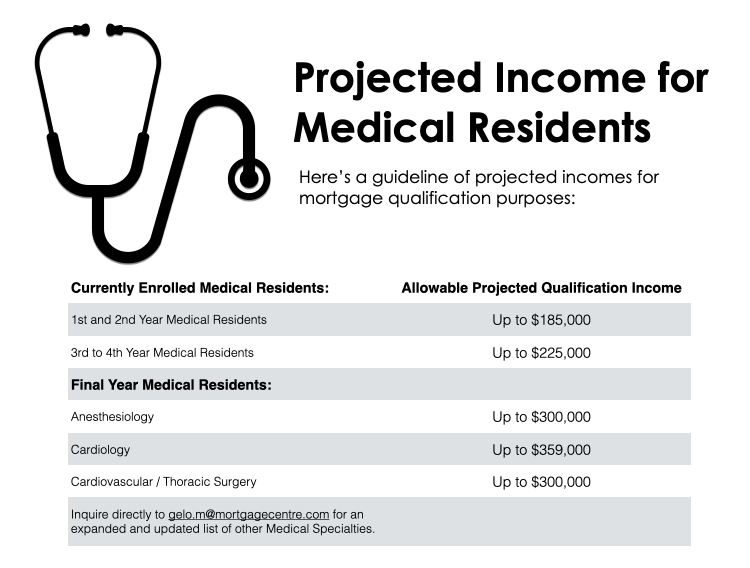

Here is a summary of Projected Incomes that can be used for mortgage qualification purposes:

Below are the key eligibility requirements for the Medical Residents Projected Income Program:

- must be registered or enrolled in a recognized medical residency or fellowship in Canada (or newly practising physicians within the last 24 months)

- foreign trained physicians are also eligible, but must be Canadian citizens or Permanent Residents and licensed by a provincial college

- a 10% minimum down payment is required of which 5% must be from your own sources. The remaining 5% can be from borrowed sources or gifted from family members

- New to Canada applicants are not eligible under the Medical Income Projected Program, but may be eligible under other niche qualification programs – inquire directly with Marko Gelo for more details

RECENT BLOGS:

Is it ok to use borrowed money for your down payment?

Credit Issues – past and present

Contact Marko, he’s a Mortgage Broker!

604-800-9593 cell/text/WhatsApp | Vancouver (Click Here to schedule a call with Marko!)

403-606-3751 cell only | Calgary (Click Here to schedule a call with Marko!)

Email Me: gelo.m@mortgagecentre.com

@markogelo (Twitter)