December 17, 2024

Breaking a mortgage before its maturity often incurs a cost: a prepayment penalty (also known as a mortgage break penalty).

For fixed-rate mortgages, lenders calculate the penalty using two methods—the three-month interest calculation and the interest rate differential (IRD)—and charge the higher amount. In contrast, variable-rate mortgages rely solely on the three-month interest calculation. Understanding how these penalties are calculated can help you better anticipate the financial implications of ending your mortgage early. In this post, I’ll delve into each type of penalty in detail and provide an example to illustrate how a prepayment penalty is determined.

Let’s start with the simpler of the two penalties: the three-month interest penalty

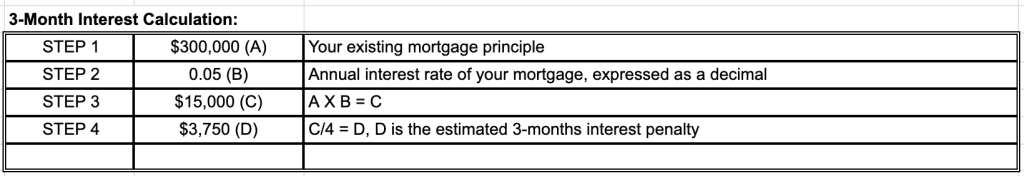

This calculation is straightforward—you pay an amount equivalent to three months’ interest on the portion of your mortgage being discharged. The formula looks like this:

3-month interest Amount = (Outstanding Mortgage Balance × Annual Interest Rate) / 4

For example, if your mortgage balance is $300,000 and your annual interest rate is 5%, the penalty would be calculated as $3,750. The three-month interest penalty is easy to understand, and it’s the sole method used for variable-rate mortgages. For fixed-rate mortgages, however, it’s only one piece of the equation, as the lender also calculates the Interest Rate Differential to determine which is greater.

The Interest Rate Differential (IRD) Penalty is a bit more complex

The interest rate differential (IRD) is calculated to compensate the lender for the interest they would lose if you broke your mortgage before its maturity, especially if prevailing interest rates are lower than your contracted rate. For instance, if you’re contractually committed to a 5-year term at 5% and you’re two years into the term with three years remaining, the lender would calculate the financial impact of discharging your mortgage and reinvesting the funds at today’s rates.

Let’s say a 3-year fixed mortgage today is available at 4%. Because you’re breaking out of your 5-year contract at 5%, the lender faces a 1% loss on the interest payments they would have earned over the remaining three years. In such a scenario, the IRD calculation would likely result in a higher break penalty than the three-month interest calculation. As a result, the lender would apply the higher of the two penalties.

The formula for the IRD Penalty is:

IRD Amount =( Your Interest Rate−Comparable Posted Rate (less Discount)) × Outstanding Mortgage Balance × Months Remaining/12

For example, if your current fixed rate is 5%, the lender’s comparable interest rate for a mortgage with a remaining term of 36 months is 4%, and your mortgage balance is $300,000, the IRD penalty would be $9,000 (calculated as follows):

As you can see from the two tables above, the IRD penalty is is greater than the Three-Month Interest Penalty, therefore, the break penalty in this case would be $9,000, not $3,750.

Here is a summary of the key variables that affect penalty calculations:

For IRD:

–Timing of Prepayment: Affects the remaining term (number of months) used in the calculation

–Posted Rates: Lender’s rates at the time of prepayment impact the Comparable Rate.

–Prepayment Amount: The higher the amount prepaid, the higher the penalty.

For Three-Month Interest:

Prepayment Amount: Larger balances lead to higher penalties.

Payment Frequency & Rate Type: Can influence the calculated penalty.

Closing Remarks

Not all mortgages calculate penalties using the standard Three-Month Interest or Interest Rate Differential (IRD) methods. Some lenders offer “no-frills” mortgages with ultra-low rates, but the trade-off often includes significantly higher break penalties. For instance, rather than basing penalties on interest, these mortgages might impose a fixed charge of 3% of the remaining balance at the time of discharge. Additionally, be cautious with mortgages that feature a cash-back option—many of these require you to repay the cash-back amount retroactively if you break the mortgage before maturity, increasing your costs.

Open mortgages, on the other hand, are typically variable-rate mortgages priced higher than regular closed variable-rate mortgages. This higher rate reflects the lender’s compromise in offering the flexibility of penalty-free early discharges. Some lenders also offer lenient terms as the mortgage approaches maturity, such as waiving penalties entirely if only a few months remain in the term. Flexible options may also include step-down penalties that decrease annually over the term.

These variations underscore the importance of carefully reviewing the fine print and understanding the trade-offs when selecting a mortgage. Finally, never assume or guess how much your penalty might be or how it is calculated. Always contact your lender directly to obtain an accurate and up-to-date penalty amount.

Wondering how much your mortgage penalty is? Contact Marko (right now!) to learn more about your mortgage terms.

CONNECT WITH MARKO:

604-800-9593 cell/text | Schedule A Call | WhatsApp | Marko’s App | gelo.m@mortgagecentre.com