Summary

(Nov 27, 2020) How reading between the lines of Business Financial Statements can result in higher qualifying incomes for self employed applicants.

The following is discussed in this episode:

When I first became a mortgage broker (in 2004), the hardest thing for me to understand at the time was how business owners got away with qualifying for hefty mortgages with such low declared incomes. Like how does a contracted engineer who declared $65,000 on their T1 General end up qualifying for a $650,000 mortgage (which requires an annual qualifying income of $100,000)?? I did quite a few deals that year and many of them in Calgary’s oil and gas sector which consisted of many self employed applicants. And it wasn’t until about my third year that I started to comprehend how someone who earned $65,000 could use $100,000 as qualifying income.

This type of scenario is prevalent with self employed applicants because their declared income could often be conceivably lower than what it really is. This is mainly the result of the various expenses that business owners claim to reduce their taxes payable. Other factors such as personal income tax reduction strategies and accumulated business retained earnings can also sway a lender to allow for a substantial bump in your qualifying income. The amount of the income bump varies with the particular lender and their program policy.

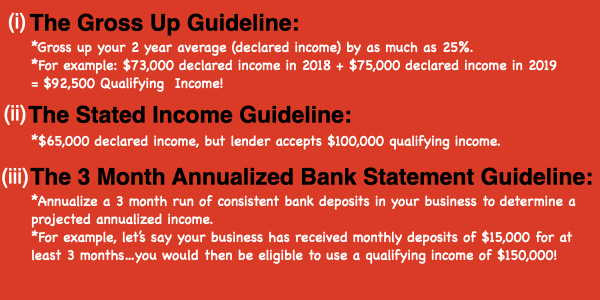

Here are the main policies in abbreviated and general terms:

All of the above scenarios are subject to the following eligibility criteria:

- minimum down payment ranges from 5% to 20%

- you must have been self employed for a minimum of 2 years, but in some instances only 3 months of self employment is required

- must have at least 25% ownership interest in your business

Rates:

Current 5 yr fixed rate range: 1.59% to 2.19%

Current Variable Rate Range: -0.80% to +0% discount off Prime (Prime Rate is 2.45%)

Comment: steady, no talk of rising interest rates this week

That’s all I got. Check in next week for more.

Marko Gelo Garage Band Sessions: (produced and performed my Marko)

- “Cheap Money” …intro song (0:41) <-Marko Gelo

- “disconnected” …outro song (1:39) <- Marko Gelo

- Sound Effects provided from Zapsplat.com and Apple Loops

Contact Marko, he’s a Mortgage Broker:

604-800-9593 direct Vancouver

403-606-3751 direct Calgary

@markogelo (Twitter)

MarkoMusic (SoundCloud Account)…all podcast music tracks are performed and produced by Marko